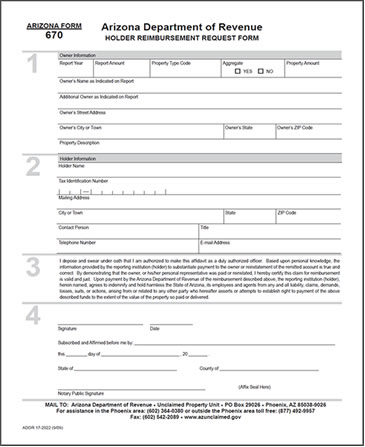

Holder Reimbursement

After a report is submitted, a holder may choose to repay the owner directly or may determine that items within the report were filed in error. In these cases, the holder may seek reimbursement by submitting the Holder Request for Reimbursement form (Arizona Form 670) along with the required documentation substantiating the repayment or error. Please use the current version, 670 revised 09/09. All other forms are obsolete and will not be accepted.

View all reporting forms and instructions

Instructions Form 670

Section 1

In this section, identify your company and designated contact.

Report Year - the year in which the requested property was reported to the State of Arizona.

Report Amount – the total dollar amount of the report you are referencing.

Property Type Code – the property type code used to identify the property you are requesting.

Aggregate – indicate if the property you are requesting was reported in aggregate form.

Property Amount - the amount of funds, shares, or tangible properties transmitted to the State, for the property in question.

Owner Name and Address - the full name and address of the owner as it is shown on the report.

Property Description – the description of the property you are requesting, such as, the identification, check, or other reference number.

Section 2

In this section, identify property for which the holder is seeking reimbursement.

Holder Name – the name of your company as listed on the Unclaimed Property Report you are referencing.

Tax Identification Number – the tax id number reported on the Unclaimed Property Report you are referencing.

Mailing Address – the mailing address of your company as declared on your most recent Unclaimed Property report (Arizona Form 650A-C).

Contact Person / Contact Information – the name of your company’s designated State contact as designated on the most recent report filed (Arizona Form 650A-C).

Section 3

In this section, carefully read the holder declarations and indemnity agreement.

Section 4

In this section, a notarized signature of the designated contact person is required.

Please Note:

- All fields in each section of the form must be completed before the State of Arizona will process your request for information or make payment.

- You are required to submit documentation to support your claim for reimbursement, which may consist of copy of cancelled check(s), front, and back, evidence of account reactivation, or a sufficient letter of explanation.

Only a company employee designated as the Unclaimed Property contact on the last report (Arizona Form 650A-C) may request a holder reimbursement. An officer of your company may change the designated contact person/ contact information by completing Arizona Form 285UP and Arizona Form 650A(Sections 1 and 2). The designated contact will be responsible for all ongoing interaction with the Arizona Unclaimed Property Unit.