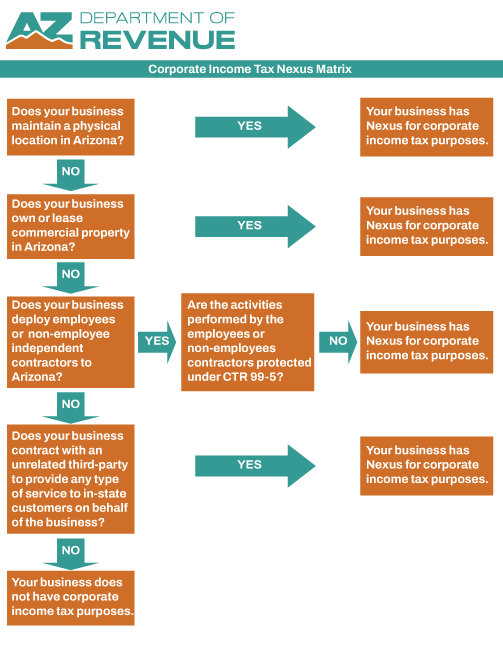

Nexus Program for Corporate Income Tax

Nexus is the connection required to exist between a state and an out-of-state potential taxpayer where the state has the constitutional right to impose a tax. The United States Constitution limits the states’ right to tax through the Due Process Clause and Commerce Clause. However, each clause has a different requirement or threshold that must be met before a state may impose a tax collection or payment responsibility on an out-of-state taxpayer.

For more details on this and Nexus, click here.

Due Process Clause

The Due Process Clause of the Fourteenth Amendment requires a definite link, a minimum connection between a state and the person, property or transaction it seeks to tax. The most minimal connections will satisfy this requirement and does not require a physical presence in the state.

Due Process also requires the income attributed to the state for tax purposes must be nationally related to values connected with the taxing state. This last requirement is rarely a bar to tax enforcement.

Commerce Clause

The Commerce Clause of the Constitution (Article 1, Section 8, C13) gives to Congress the power to regulate commerce among the states. Therefore, a state may not impermissibly affect interstate commerce without congressional authorization. The U.S. Supreme Court held in Complete Auto Transit (430 US 274 (1976)) that a state does not impermissibly affect interstate commerce if it meets each of four tests:

- The taxed activity has a substantial nexus to the taxing state.

- The tax is fairly apportioned among states.

- The tax does not discriminate against interstate commerce.

- The tax is fairly related to services provided by the taxing state.

The area of greatest confusion in this four-part test is what constitutes “substantial nexus” for complete auto test purposes. This issue of nexus most commonly arises with either the transaction privilege and use tax, or the income tax.

If you have read the above information and still require additional guidance in order to make a nexus determination, you may complete the Nexus Questionnaire. Completed questionnaires will be reviewed by a Nexus Auditor, and a determination will be provided by the Department.

If you have read the above information and still require additional guidance in order to make a nexus determination, you may complete the Nexus Questionnaire. Completed questionnaires will be reviewed by a Nexus Auditor, and a determination will be provided by the Department.