TPT Notices and Correspondence Resource Center

Welcome. The notice or letter you received explains the reason(s) for the contact and provides instruction on how to make corrections. This webpage provides additional resources and helpful information.

Helpful Resources

Please use the links below to navigate to additional helpful resources.

AZTaxes – File and pay online.

E-Services – Electronic filing and payment requirements, accounting credit and electronic funds transfer program.

Licensing Fees - State TPT licensing fees are calculated per business location. To calculate the city license fees, multiply number of locations by the license fee. City fees are subject to change.

Quick Reference - Several online resources and tips to assist you in filing and paying online with AZTaxes.gov.

Transaction Privilege Tax Tutorials – Step-by-step guides.

Common TPT Errors and How to Avoid Them - Helpful video showing common issues (watch on YouTube).

Workshops – Attend a workshop to learn more.

Glossary of Terms

The State of Arizona allows a credit for accounting and reporting expenses which results in a reduction of the amount of state tax owed. The accounting credit is applicable only to the state’s transaction privilege tax and/or severance tax. The credit does not apply to city, county or other taxes. Tax returns must be filed and paid on time for accounting credits to apply.

An accounting credit rate is an allowable percentage a business uses to calculate the accounting credit. The rate is .0675% of the state tax due when filing electronically for the business classification retail. The credit must be calculated by the taxpayer and included on the transaction privilege tax (TPT) return where it reduces the amount of state tax owed. There are different accounting credit rates for other business classifications. Accounting credit rates for TPT business codes are available on the tax rate table.

When filing an amended return understand that a new return is being filed and will replace the one previously submitted. Credit will be given for the taxes paid with the original return. Negative numbers should not be used when submitting a return to amend a prior period. Contact Customer Care at (602) 255-3381 for more information.

A business classification defines the business activity or types of business activities. Business classifications are defined in Arizona Revised Statutes, Title 42. The Arizona Department of Revenue assigns a three digit business code to represent a business classification in a numeric fashion. Even though the business classification may be the same, the assigned business code may be different between the state and city.

A business code is a three-digit number assigned to a corresponding business activity. Business codes can be found in the Tax Rate Table: (e.g., 017 is the business code assigned to retail business). Please refer to the rate table for the business code you are to use, the business code used for the state may not be the same used for the city in the same business classification.

City codes identify the cities or towns in which business activities are conducted. A city code is identified by two letters (e.g., the Town of Gilbert’s city code is GB). City codes are listed on the Tax Rate Table, please refer to the rate table for the city code.

This code is important as it allows the Department to properly collect and disperse taxes generated by businesses in a specific area to the correct city/town or district.

All sales are reported but may not be subject to tax if a deduction or exclusion applies. In this case, there will be a deduction code to use when reporting. The deduction codes are not interchangeable between business classifications or cities. The deduction used must be specific to the business classification that is reported. Authorized deductions are listed in the deduction code listing. Use the listing that is pertinent to the reporting period you are filing. The listing can be found here: Deduction Codes.

A deduction code is a three-digit number assigned to a deduction. Deductions are applicable to specific business classifications and/or regions. All city and state deduction codes as well as marketplace facilitators and remote sellers’ deduction codes are available at Deduction Codes.

Businesses with annual transaction privilege tax and use tax liability over the current TPT threshold are required to file and pay electronically. Taxpayers who are required to pay electronically are subject to a penalty charge of 5 percent of the amount of payment when payment is made by check or cash. See TPT Thresholds for more information.

Businesses with annual transaction privilege tax and use liability over the current TPT threshold are required to file and pay electronically. Taxpayers who are required to file an electronic return are subject to a penalty of 5 percent of the tax amount due for filing a paper return. The minimum penalty is $25, including filings with zero liability. See TPT Thresholds for more information.

Taxpayers who file their return late are subject to a late file penalty of 4.5 percent of the tax required to be shown on the return for each month, or fraction of a month, the return is late. There is a minimum penalty of $25 and a maximum of 25 percent of the tax due or $100, per return, whichever is greater. See TPT Thresholds for more information.

Arizona Revised Statute §42-5014.D requires an estimated payment if a taxpayer’s actual combined tax liability for transaction privilege, telecommunication services excise and county excise taxes in the preceding calendar year was $3,100,000 or more in 2022, or $4,100,000 or more in 2023 and each year thereafter, or if the taxpayer can reasonably anticipate a liability for such taxes or more in the current year. By statute, estimated tax payments are due in June.

Arizona Administrative Code rule R15-10-302 requires taxpayers under transaction privilege tax (TPT) with a total annual liability of $5,000 or more to remit these tax payments by electronic funds transfer.

Excess tax is tax collected in surplus of the tax rate for the region(s) reported. By law, if a taxpayer collected more tax than is calculated as due, the combined excess tax must be reported and paid to the Arizona Department of Revenue. If the taxpayer over collected the city tax, the overage must be reported as city excess tax. If state tax was over collected, the overage will be reported as state excess tax.

The purpose of the exemption certificate is to document and establish a basis for state and city tax deductions or exemptions. The document is filled out completely by the purchaser and furnished to the vendor at the time of a sale. The form is kept by the vendor, it is not necessary to send the form to the department. See TPP 17-1 for more information on the various exemption certificates and how to complete the forms.

Also referred to as “gross income”, gross receipts include the total amount of all receipts or value of the sale, service, lease, license for use, rental, or other taxable activity. Gross receipts transactions can include: cash; credits; barter; exchange; reduction of, or forgiveness of, indebtedness and property of every kind or nature.

Location codes are unique, three-digit numeric codes that are tied to business addresses where the business transactions are taking place. The codes are assigned by the department and are listed on the transaction privilege tax (TPT) license certificate, and can be located on the left side of the certificate just below the address.

This location code is important as it allows the department to properly collect and disperse taxes generated by businesses in a specific area to the correct city/town or district they belong.

Any person or business operating a marketplace (e.g., website) and facilitating transactions between a buyer and retailer/wholesaler. A marketplace facilitator accepts payment on behalf of the retailer/wholesaler.

Name of region is typically the name of an Arizona county or a special district within the state.

Net taxable income is the total amount of income subject to tax after deductions are subtracted from gross receipts.

An online lodging marketplace is a digital platform that provides, at a cost, unaffiliated third parties with a platform where lodging accommodations can be rented.

A region code is used to identify the county and/or the city where business transactions are sourced. This code is important as it allows the department to properly collect and disperse taxes generated by businesses in a specific area to the correct county or district. A region code is identified by three letters (e.g., the Maricopa region code is MAR). Region codes are listed on the Tax Rate Table, please refer to the rate table for the county code.

A remote seller is any person or business that is selling and/or shipping products into Arizona but has no physical presence in the state.

A returned payment is an account payment that has been dishonored by the business’ banking or credit institution. Insufficient funds, incorrect routing and/or account numbers are common causes for returned payments, and a charge of $50 to the account will be applied.

Schedule A is the location on tax return forms TPT-2 and TPT–EZ where deduction codes are used to explain the income that is exempt or excluded from tax. The same region and/or city codes used in reporting income are used in the Schedule A to claim deductions of nontaxable or exempt income.

A tax correction notice (TCN) is a correspondence letter sent by the Arizona Department of Revenue to inform taxpayers of important account matters or changes.

For transaction privilege tax, the tax rate is the rate at which business activity is taxed. This rate depends on the entity’s business classification and region or jurisdiction. Arizona cities and towns are responsible for determining the tax rate for their jurisdiction. See the Tax Rate Table to see a listing of tax rates for each region or jurisdiction.

A taxpayer identification number is an identifying number used for tax purposes. This number is unique number assigned to a taxpayer or entity.

Transaction details are information that may include region codes, location codes, business codes, gross income and deductions that must be accurately completed on the return in order for the return to post accurately to a taxpayer’s account.

Transaction privilege tax, also referred to as TPT, is a tax on the privilege of engaging in certain taxable activities within the state of Arizona. This tax is levied on the gross proceeds or gross income derived from business-related activities and is imposed directly on the vendor who may choose to pass the economic burden forward to the consumer.

File Online Using AZTaxes.gov

While the department does allow those individuals whose annual liability is $500 or less to file paper returns, we strongly encourage all taxpayers to file and pay using our online tax system at AZTaxes for faster and more efficient processing.

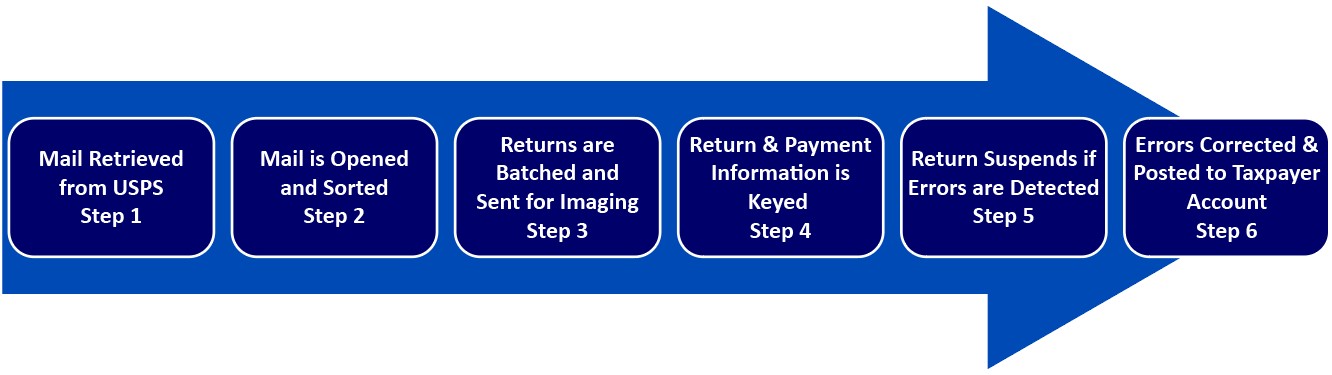

Paper Return Process

The processing of paper returns can be a lengthy endeavor. While the department strives to process all paper returns in a timely and accurate manner, this process can take anywhere from 5-20 days depending upon the tax type, volume and peak times.

Electronic Return Process

Tax Correction Notice

A tax correction notice (TCN) is a correspondence sent out by the department to inform a taxpayer that a correction has been made on a specific return that was filed. This correspondence could generate for a number of reasons. Using the information listed on the correspondence, select the applicable resource(s) for additional helpful information:

An incorrect accounting credit was reported for the business code. Accounting credits can be claimed on returns that are timely and paid in full. These credits are applicable to activity at the state and county regions only and are not applicable to all business codes. For example, commercial lease businesses, online lodging marketplaces and businesses reporting only use tax are unable to claim this credit. To claim this credit, ensure the business code is eligible to receive the accounting credit and submit an amended return. If the business code was not eligible to receive the accounting credit, please pay the balance indicated on the correspondence by the due date in order to avoid additional penalties and interest.

For more information on the Accounting Credit, click here.

For more information on submitting an amended return using AZTaxes.gov, click here.

To view Accounting Credit rates and the Business Codes that can claim this credit, click here.

Visit AZTaxes.gov to file and pay electronically.

City Builder Credits claimed under City Transaction Details were not allowed for the business code reported. City Builder Credits can be claimed by owner-builders or by speculative builders for Business Code 016. These credits apply at the city region level only. To claim this credit, ensure the reported business code is eligible to receive the accounting credit and file an amended return. If the business code was not eligible to receive the City Builder Credit, please pay the balance indicated on the correspondence by the due date in order to avoid additional penalties and interest.

For more information about the distinction between a speculative builder and an owner-builder, click here.

For more information about speculative builders, click here.

For more information about owner-builders who are not speculative builders, click here.

For more information on submitting an amended return using AZTaxes.gov, click here.

Visit AZTaxes.gov to file and pay electronically.

There was a calculation error on the TPT return submitted. Deductions listed in the Schedule A of the TPT return must be complete and must match the Transaction Detail Deductions to be allowed. Please ensure calculations are correct and that all information has been included. If information was missing on the return, please submit an amended return with necessary corrections. Otherwise, please pay the balance indicated on the correspondence by the due date in order to avoid additional penalties and interest.

Filing returns on AZTaxes.gov ensures these calculations are always accurate and helps avoid return errors.

For a step-by-step guide on how to complete a Transaction Privilege Tax return, click here.

For more information on submitting an amended return using AZTaxes.gov, click here.

Visit AZTaxes.gov to file and pay electronically

Tax activity was reported using a business code that was not previously on the TPT license. The department added the business code to the account. Please verify the code information used was correct. If the code was used in error, amend the return and remove the incorrect business code from the license using AZTaxes.gov.

For more information on updating the TPT account using AZTaxes.gov, click here.

For more information on submitting an amended return using AZTaxes.gov, click here.

Visit AZTaxes.gov to file and pay electronically.

Tax activity was reported using a location code not listed on the TPT license. Location code information is available on the business’ registered AZTaxes.gov account and on the TPT license. Tax activity reported at the city region level must be reported under existing location codes. Location codes are not used to report tax activity at the state/county level. If a location code was used in error, please amend the return. Please use AZTaxes.gov to add or remove locations from the TPT license.

For more information on location-based reporting, click here.

For more information on updating the TPT account using AZTaxes.gov, click here.

For more information on submitting an amended return using AZTaxes.gov, click here.

Visit AZTaxes.gov to file and pay electronically.

The deduction code claimed on the return is not applicable to the business code reported. Deductions can only be claimed for allowable business class activity. As a result, the deduction was disallowed. The deduction code list was updated October 1, 2019. Please ensure the deduction code corresponds to the filing period. To claim the deduction, file an amended return ensuring proper deduction codes and business codes are used. Otherwise, please pay the balance indicated on the correspondence by the due date in order to avoid additional penalties and interest.

File online at AZTaxes.gov to ensure only applicable deduction codes for the business code can be reported.

For more information on deduction codes, click here.

For more information on business codes, click here.

Visit AZTaxes.gov to file and pay electronically.

Invalid city region code details were reported. The reported city region code is not currently associated with the TPT license. The department added the city region code to the TPT license. Please verify the code information used was correct. If the city region code is not correct, please amend the return and use AZTaxes.gov to remove the incorrect code from the TPT license.

Note: If the city region code used is correct, additional city licensing fees may apply.

For more information on city licensing fees, click here.

For more information on updating the TPT account using AZTaxes.gov, click here.

For more information on submitting an amended return using AZTaxes.gov, click here.

Visit AZTaxes.gov to file and pay electronically.

Tax figures with negative numbers were reported resulting in an underpayment. Values less than zero are not allowed on TPT returns. Please verify the return information and file an amended return to correct the errors.

For a step-by-step guide on how to complete a Transaction Privilege Tax return, click here.

Filing returns on AZTaxes.gov ensure calculations are always accurate.

The net tax amount reported was different than the calculated amount and has been adjusted by the department to correct the return. Math errors or tax rate changes can often cause miscalculations. Please verify the figures and/or the tax rates and file an amended return if necessary.

File returns online using AZTaxes.gov to ensure calculations are accurate. Click here to view tutorials on how to complete the new user registration and how to file/pay returns online.

For more information on tax rates, click here.

For more information on submitting an amended return using AZTaxes.gov, click here.

Visit AZTaxes.gov to file and pay electronically.

The total tax amount reported was different than the calculated amount and has been adjusted by the department to correct the return. Math errors or tax rate changes can cause miscalculations. Please verify figure and/or tax rates and file an amended return if necessary.

File returns online using AZTaxes.gov to ensure calculations are accurate. Click here to view tutorials on how to complete the new user registration and how to file/pay returns online.

For more information on tax rates, click here.

For more information on submitting an amended return using AZTaxes.gov, click here.

Visit AZTaxes.gov to file and pay electronically.

Corresponding tax rates were missing for the return period. Please review new or archived tax rate tables for the applicable period. Please correct the information and file an amended return.

To view current and archived tax rates, click here.

For more information on tiered tax rates, click here.

For more information on submitting an amended return using AZTaxes.gov, click here.

Visit AZTaxes.gov to file and pay electronically.

An incorrect business code was used for an unregistered remote seller or marketplace facilitator account. Only qualifying, registered remote sellers or marketplace facilitators may use the 600 series business codes. If the business is a remote seller or marketplace facilitator that needs to convert its account, contact the ECCO Team by email at [email protected]. If the business does not qualify as a remote seller or marketplace facilitator, please verify the business code and submit an amended return.

To verify how the business is currently registered, click here.

For more information on remote seller and marketplace facilitators, click here.

For more information on standard business codes, visit the tax rate table by clicking here.

For more information on submitting an amended return using AZTaxes.gov, click here.

Visit AZTaxes.gov to file and pay electronically.

Transaction details are missing or were incomplete on the TPT return. A TPT form must be completed in its entirety and with accuracy. Verify the return information and submit an amended return to correct the filing.

Filing returns on AZTaxes.gov ensures returns are always accurate.

For more information on submitting an amended return using AZTaxes.gov, click here.

Visit AZTaxes.gov to file and pay electronically.

An incorrect business code was used for a marketplace facilitator account. Qualifying, registered marketplace facilitators are required to use 600 series business codes. Contact the ECCO Team by email at [email protected] for help with account conversions. Please verify the business code and submit an amended return to correct the filing.

To verify how the business is currently registered, click here.

For more information about business codes for marketplace facilitators, click here.

For more information on submitting an amended return using AZTaxes.gov, click here.

An incorrect business code was used for a remote seller account. Qualifying, registered remote sellers are required to use 600 series business codes. Contact the ECCO Team by email at [email protected] for help with account conversions. Please verify the business code and submit an amended return to correct the filing.

To verify how the business is currently registered, click here.

For more information about business codes for remote sellers, click here.

For more information on submitting an amended return using AZTaxes.gov, click here.

The business code reported in the transaction details is incorrect. This business code is not currently included on the TPT license. Review new and archived tax rate tables to see applicable business codes. Please verify the business code and submit an amended return to correct the filing.

For more information about Business Codes, click here.

For more information on submitting an amended return using AZTaxes.gov, click here.

The department accepts payments made by cash, check, e-check, ACH debit, and debit/credit cards. Returned payments may result for various reasons. In addition to insufficient funds, incorrect routing or account numbers may cause payments to be dishonored by banking institutions. Please verify the payment method and resubmit to avoid additional fees.

For more information on the non-sufficient funds penalty, click here.