Forms Technical Information

Forms are fillable when available.

Please ensure you download and open the form from your computer folder using Acrobat, as you will encounter issues when viewing and filling it out within your internet browser.

Then you can complete and print or print and complete by hand.

Fillable forms are in PDF format and contain JavaScript coding, which means some fields calculate and do the math for you.

Error Message: If you receive a page with WARNING or error message, please download and open the form from your computer folder using Acrobat Reader or view the form in Internet Explorer.

Viewer

Forms require Adobe Acrobat Reader 10.0 or higher for viewing.

How your PDF viewer affects your ability to use fillable forms:

- Our fillable forms are PDF forms designed to work with Adobe Acrobat Reader (version 7.0 and above).

- To download Acrobat Reader, visit Adobe’s website. If you have the Acrobat Reader open, click "Help", then "Check for Updates.”

- Adobe Acrobat ensures that the dynamic content fields and calculations on our fillable forms work as intended.

- Most computers have Adobe Acrobat software as the default PDF reader (Apple does not).

Browser

If you see a blank/warning/error message, please view the form within your computer's Download folder instead of online.

How your web browser affects your ability to use fillable forms:

- Popular alternate browsers (Chrome, Mozilla Firefox, Safari, Opera) disable JavaScript for security reasons.

- Since our fillable forms require JavaScript, they will not work properly, even though they may appear to be working at first.

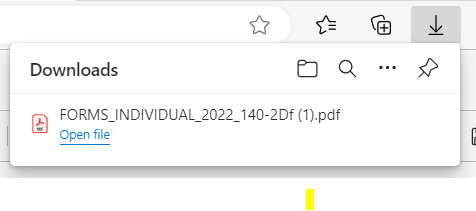

Download in Google Chrome

If you see a blank/warning/error message, please view the form within your computer's Download folder instead of online.

For Google Chrome, it will open the form within your browser. You must download the form and open form on your computer under the Download folder, or where you have designated files to save. Most cases, it saves in C:/Users/NAME/Downloads.

Clicking on the PDF in the bar located at the bottom of the screen simply opens the form in the browser, but it is also saved in the folder where you can access it later to work on. ADOR recommends saving so it will be on your computer to fill out and save for your electronic records.

![]()

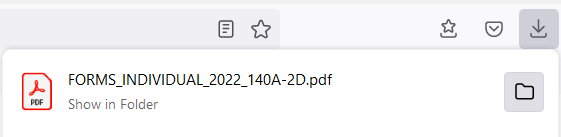

Download in Microsoft Edge (Internet Explorer)

If you see a blank/warning/error message, please view the form within your computer's Download folder instead of online.

For Microsoft Edge (Internet Explorer) downloads save this file to your computer under the Download folder, or where you have designated files to save. Most cases, it saves in C:/Users/NAME/Downloads.

Click the down arrow in the upper right corner of the browser, then the "Open file." This opens up your File Explorer to where you saved the file. Open the file and work on your tax return from this file.

Download in Mozilla Firefox

For Mozilla Firefox, downloads save to your computer under the Download folder, or where you have designated files to save. Most cases, it saves in C:/Users/NAME/Downloads.

Next, click the down arrow in the upper right corner of the browser, then the folder icon. This opens up your File Explorer to where you saved the file. Open the file and work on your tax return from this file.

Download in Safari

At this time, fillable forms are not available through Safari. ADOR recommends saving so it will be on your computer to fill out and save for your electronic records.

Operating System

Fillable forms can be used on all operating systems, but recommend not filling out forms on mobile devices or tablets due to software and application requirements.

Apple computers use Preview software, which does not support all of the functions within our forms.

If you are using a computer that does not have Adobe Acrobat Reader as the default PDF reader, you will need to download and/or set it as the default PDF reader.

For more information on Acrobat for Mac, visit https://helpx.adobe.com/acrobat/kb/install-reader-dc-mac-os.html

Frequently Asked Questions

If you are using internet browser and see a blank/warning/error message, please download the form and view the form within your computer's Download folder instead of online.

After downloading, open the file directly from your computer folder, or you will get the same error when viewing it within your browser.

Download forms by clicking the Download button on any of the form pages. When downloading forms or instructions, each browser is different on how it downloads to your computer. For more information on how each browser downloads the form, click here.

Apple computers use Preview software, which does not support all of the functions within our forms. Open the form with Adobe Acrobat Reader.

To download Acrobat Reader, visit Adobe’s website.

ADOR offers blank forms on our website by searching “non-fillable” at https://azdor.gov/forms.

NOTICE: For tax year 2023 and beyond, there are no longer non-fillable individual income forms. Please use and print the fillable form instead.

Fillable calculating forms must be filled out with the top red required fields before printing. This is to prevent taxpayers from sending in incomplete forms. If you want to print a blank form, click the Print button on top of the page before filling out any of the fields.

Yellow fields are read-only and calculate when entering data into other fields that relate to them. For examples, subtotals and lines that state “from Arizona Form X, line x.”

Ensure all necessary lines are entered, especially deduction, gross receipts, and tax rate.

Some software default to asking for a password. You can simply say "Cancel" when prompted.

Our fillable forms are designed to work with Adobe Acrobat Reader (version 7.0 and above).

To download Acrobat Reader, visit Adobe’s website. If you have the Acrobat Reader open, click "Help", then "Check for Updates.”

Need more help? If you are still experiencing difficulties using our fillable forms, please contact the Arizona Department of Revenue to report your problem.

If you have tax and legal questions, please contact [email protected].