Location Based Reporting

For each transaction privilege tax license, the Arizona Department of Revenue assigns unique location code(s) to identify the location or locations where business transactions are taking place. All businesses must specify their assigned location code for each separate business location when filing their transaction privilege tax return.

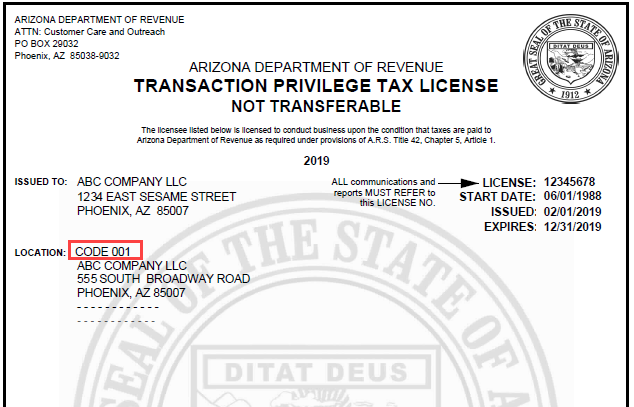

The location code can be found on the Transaction Privilege Tax (TPT) License Certificate. It is the 3-digit number located on the left side below the address.

This location code is important as it allows the department to properly collect and disperse taxes generated by businesses in a specific area to the correct city/town or district they belong.

Filing and paying on AZTaxes.gov is the recommended method of filing your transaction privilege tax return. All location code information is available using this method.

For more assistance or to receive a copy of your license certificate, please contact us.