Filing Requirements

Arizona transaction privilege tax (TPT) differs from the sales tax imposed by most states. It is a tax on the privilege of conducting business in the State of Arizona. Unlike a true sales tax, the TPT is levied on income derived by the seller that is legally allowed to pass the tax burden on to the purchaser. However, the seller is ultimately liable to Arizona for the tax.

Beginning October 1, 2019, any remote seller or marketplace facilitator with economic nexus that fails to report and remit TPT, could be subject to penalties and interest.

A marketplace seller that only sells through marketplace facilitator(s) will not be required to be licensed or report, so long as they have an exemption certificate(s) or other proper documentation indicating that the marketplace facilitator will file TPT on behalf of the marketplace seller.

Exemption certificates can be found here.

A remote seller is required to obtain an Arizona TPT license if its sales into Arizona meet or exceed the applicable threshold for the previous or current calendar year. A remote seller will report all of its Arizona sales by jurisdiction and is responsible for remittance of state, county and city transaction privilege tax. The remote seller uses the same 600 series business codes to report all Arizona sales.

A remote seller that also sells its products through a marketplace facilitator, which it does not itself operate, will report sales made through the marketplace(s) (using the same 600 series business codes) and then take a deduction for the amount of such sales (using deduction code 804). The remote seller must obtain an exemption certificate(s) from the marketplace facilitator(s). The marketplace facilitator(s) report and remit TPT on the remote seller’s behalf.

The business codes and rate table for remote sellers can be found here.

Exemption certificates can be found here.

Note: The sales through a marketplace facilitator do not count towards the remote seller’s filing thresholds.

All marketplace facilitators whether in Arizona or out-of-state must provide their marketplace sellers with exemption certificates (Form 5020), which documents that the marketplace facilitator will be responsible for reporting and paying the tax on its marketplace sellers’ sales into Arizona.

An out-of-state marketplace facilitator is required to obtain an Arizona TPT license if sales on its marketplace to Arizona customers meet or exceed the applicable threshold for the previous or current year. An out-of-state marketplace facilitator will report and remit TPT on its own sales using the 600 series business codes. The out-of-state marketplace facilitator will also report sales made behalf of their marketplace sellers using the same 600 series business codes. All Arizona sales must be reported by jurisdiction. Note: A marketplace facilitator will use location code 001 when reporting for the municipalities.

A marketplace facilitator with a physical presence in Arizona is required to obtain a TPT license, regardless of any sales thresholds. It must also report and remit its sales as well as the sales of any of its marketplace sellers’ sales to Arizona customers. Sales to customers outside of Arizona are likely not taxable in Arizona, but may be taxable in another state. The Arizona marketplace facilitator must report its sales using business code 017 and report sales made on behalf of marketplace sellers (third-party sales) using business code 605. Note: A marketplace facilitator will use location code 001 for their marketplace sellers when reporting for the municipalities. Please see the rate table for the 600 series and other business codes.

Filing Examples

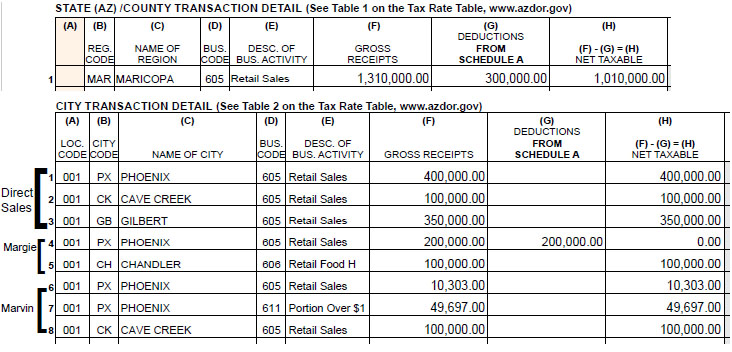

Filing example of a marketplace facilitator (facilitator) with no physical presence in Arizona reporting its sales and those of its marketplace sellers. The sales are reported by jurisdiction; no deductions are addressed except those pertaining to the example.

| Description of Sales | Result |

|---|---|

|

Out-of-state facilitator’s total direct sales are $850,000. Breakdown of sales by jurisdiction: |

The facilitator with no physical presence in Arizona will report its sales using the codes for Retail Sales, business code 605. This code will be used to report sales for Arizona and any county. The same code will be used to report the facilitator’s direct sales that were shipped into the cities of Phoenix, Cave Creek and Gilbert. These sales are reported by JURISDICTION. |

|

Margie, a marketplace seller, sells through the facilitator’s marketplace: Total sales (food for home consumption sales) into Arizona are $300,000. Breakdown of sales by jurisdiction: |

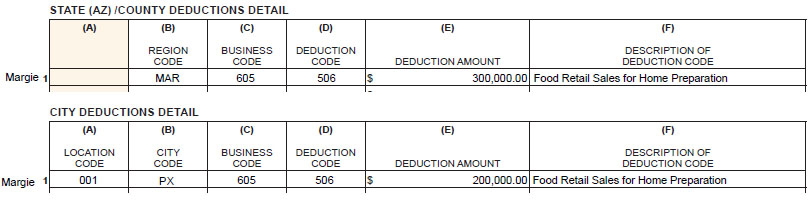

Margie sells food for home consumption. Food for home consumption is not taxable for state or county purposes. However, some cities do impose a tax on food for home consumption. The food sales in those jurisdictions that DO NOT tax food will be reported by the facilitator using the Retail Sales business code 605 and deducted using deduction code 506. This reporting method would be used for the City of Phoenix, which does not tax food. Because the City of Chandler taxes food, the facilitator will report these sales using business code 606 and have no other deductions. These sales are reported by JURISDICTION. Margie does not have any other sales other than sales on the facilitator’s marketplace and is not required to be licensed or report. |

|

Marvin, a marketplace seller, sells into Arizona through a facilitator. Such sales total $160,000, with one “big-ticket item sale”. Breakdown of sales by jurisdiction: |

Marvin made one “big-ticket item sale” of $60,000 that was shipped to Phoenix. This city has a tiered rate structure on a single item sold with a value of over $10,303 (i.e., the threshold in effect from Jan. 1, 2018 through Dec. 31, 2019). More than one tax rate applies to this type of sale. The facilitator will report the $60,000 sale by splitting the sale into two parts. The first $10,303 is reported under the Retail Sales business code 605. The remaining $49,697 is reported under tiered rate business code 611, which has a different rate. See the explanation of the tiered rates for more information. The sale shipped to the Town of Cave Creek is reported using Retail Sales business code 605. These sales are reported by JURISDICTION. Marvin does not have any other sales other than sales on the facilitator’s marketplace and is not required to be licensed or report. |

Reporting the Transaction

* Please note this example is to demonstrate the different types of retail transactions that require separate filing requirements. Generally, all gross receipts and deductions for a specific city and business code will be reported together. E.g., Cave Creek gross receipts under business code 605 would be reported as $200,000.00.

Reporting the Deductions (Schedule A)

Physical Presence

A marketplace facilitator with a physical presence (storefront, people or equipment) in Arizona will file under separate business codes. The marketplace facilitator will report its sales under one set of business codes and their marketplace sellers' sales under a separate set of business codes.

Filing Examples

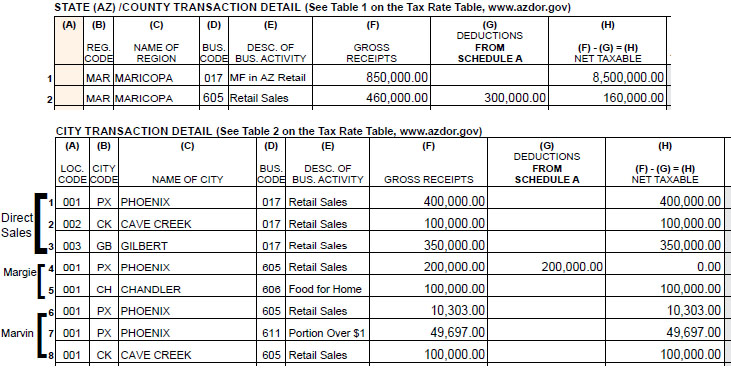

Filing example of a marketplace facilitator (facilitator) with a physical presence in Arizona reporting its direct sales and those of marketplace sellers utilizing different business codes. The sales are reported by jurisdiction and no other deductions are addressed except those pertaining to the example.

| Facts | Result |

|---|---|

|

Arizona facilitator’s total direct sales are $850,000. Breakdown of sales by jurisdiction: |

Facilitator’s direct sales are reported using the codes for Retail Sales, business code 017, for state/county reporting, as well as reporting their direct sales. Facilitators with a physical presence in Arizona use the state/county and city codes based on where the order is received within the state. As a business with PHYSICAL LOCATION(s), they will report by LOCATION(s). |

|

Margie, a marketplace seller, has total sales (food sales) into Arizona of $300,000. Breakdown of sales by jurisdiction: |

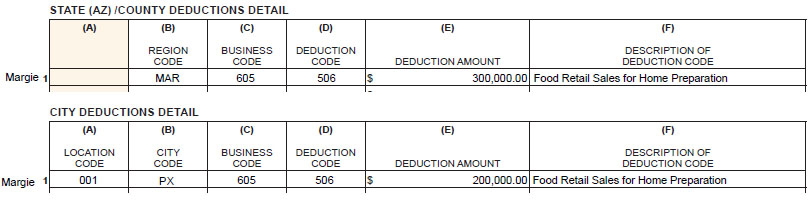

Margie sells food for home consumption. The State of Arizona does not tax food for home consumption, although some cities do. The facilitator must use a different code for these third-party sales. These sales are reported by JURISDICTION. The facilitator reports food sales in the jurisdictions that DO NOT tax food utilizing the Retail Sales business code 605 and deducted using deduction code 506. The facilitator would report for the City of Phoenix in this matter because it does not tax food for home consumption. Because the City of Chandler does tax food, these sales will be reported using business code 606, and there are no other deductions. Margie does not have any sales other than sales on the facilitator’s marketplace and is not required to be licensed or report. |

|

Marvin, a marketplace seller, sells into Arizona. Such sales total $160,000, with one “big-ticket item sale”. Breakdown of sales by jurisdiction: |

Marvin made one “big-ticket item sale” of $60,000 shipped to Phoenix. This city has a tiered rate structure on the sale of a single item with a value over $10,303 (i.e., the threshold in effect from Jan. 1, 2018 through Dec. 31, 2019). There are different rates applied to this type of sale. The facilitator must use a different code for these third-party sales. These sales are reported by JURISDICTION. The facilitator will report the $60,000 sale by splitting the sale into two parts. The first $10,303 is reported under the Retail Sales business code 605. The remaining $49,697 is reported under tiered rate business code 611, which has a different rate. See the explanation of the tiered rates for more information. The sale shipped to the Town of Cave Creek is reported using Retail Sales business code 605. Marvin does not have any other sales other than sales on the facilitator’s marketplace and is not required to be licensed or report. |

Reporting the Transaction

*Please note this example is to demonstrate the different types of retail transactions with separate filing requirements. Generally, all gross receipts and deductions for a specific city and business code will be reported together. E.g., Phoenix gross receipts under business code 605 would be reported as $210,303.00.

Reporting the Deductions

Filing Examples

Filing example of a remote seller that makes direct sales into Arizona through its website and the website of a marketplace facilitator. The remote seller does not have a physical presence in Arizona. The sales are reported by jurisdiction and no deductions are addressed except those pertaining to the example.

| Facts | Result |

|---|---|

|

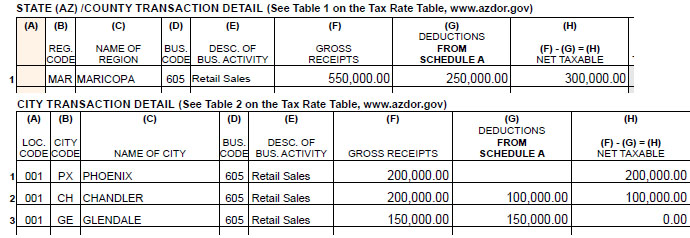

Remote seller makes sales into Arizona through its website and ships to the following cities: $200,000 shipped into Phoenix. |

The remote seller will report these sales using Retail Sales business code 605 for both the state/county and the cities the product is shipped to. These sales are reported by JURISDICTION. |

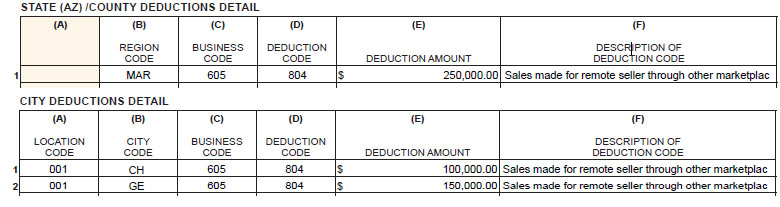

|

Remote seller makes sales into Chandler and Glendale through a marketplace facilitator’s website. The remote seller received an exemption certificate from the marketplace facilitator for these sales. The sales are shipped to the following cities: $100,000 shipped into Chandler. |

The remote seller will report these sales using business code 605 and deduct them under deduction code 804 because the marketplace facilitator has the responsibility for reporting and paying tax on these sales. The marketplace facilitator has given the remote seller an exemption certificate attesting it will do so. These sales are reported by JURISDICTION. |

Reporting the Transactions

Reporting the Deductions

The business codes and rate table for a marketplace facilitator can be found here.